Taking out a loan can seem daunting, particularly when it comes to understanding your monthly payments. Luckily, calculating your loan amount doesn't have to be a headache. With the suitable tools and information, you can swiftly figure out exactly what you'll be owing each month. First, gather the essential details about your loan, such as the principal sum, interest rate, and duration. Then, utilize available tools to input these values and receive a clear breakdown of your monthly payments. This will provide you valuable insight into the overall cost of your loan and help you form informed financial decisions.

- Many online calculators are present that can simplify this process for you.

- Don't hesitate to speak with a financial advisor if you have any questions about your loan payments.

Calculate Your Monthly Mortgage Payments With A Quick Mortgage Calculator

Owning a home is a dream for many, but the financial aspect can sometimes feel daunting. A key factor in understanding your affordability is knowing exactly how much your monthly mortgage payments will be. That's where a mortgage calculator comes in handy. This instrument allows you to input various factors like the loan amount, interest rate, and loan term to produce an estimated monthly payment.

By employing a mortgage calculator, you can rapidly visualize different scenarios and figure the best loan options that suit your financial situation. It's a valuable asset for homebuyers, helping them make informed decisions about their future.

Effortlessly Compute Your EMI quickly

Calculating your Equated Monthly Installment (EMI) can feel daunting, but it doesn't have to be. With the right tools and a little understanding, you can compute your EMI effortlessly. Start by gathering essential information like the loan amount, interest rate, and loan tenure. There are plenty online EMI calculators available that guide you through the process step-by-step. Simply input your details and let the calculator do the heavy lifting. You'll receive an accurate EMI figure in minutes, allowing you to manage your finances effectively.

Grasp Your Financial Obligations with an Loan Interest Calculator

Planning a significant purchase or exploring financing options? An interest rate calculator can be a valuable tool to help you assess the true cost of borrowing. By inputting key details like the loan amount, term length, and interest rate, these calculators provide a detailed breakdown of your monthly payments and total interest paid over time. This empowers you to make informed decisions debt repayment calculator and avoid potential financial pitfalls.

- Utilizing an interest rate calculator can help you evaluate different loan offers and choose the most favorable option.

- It allows you to estimate your monthly budget impact, ensuring that the loan payments are sustainable within your financial constraints.

- Moreover, an interest rate calculator can expose the long-term effects of interest accrual, helping you understand the true value of borrowing versus saving.

Loan Calculators: Your Financial Tool

These web-based tools can aid you in determining the expenses associated with a mortgage and help you make smart budgetary decisions. Using a finance calculator is easy. Just input the relevant information, such as the amount, interest rate, and period. The calculator will then display you the periodic payments.

Additionally, some calculators can project your long-term expenses. This can guide you in saving for a finance and guarantee that you can meet your monthly payments.

Whether you are exploring a mortgage, a personal loan, or any other type of funding, a mortgage calculator is an essential tool to have in your financial toolkit.

Intelligent Calculations for Loans and Mortgages

Securing a loan is a significant financial step, and understanding the nuances involved is crucial. Employ smart calculations to assess your possibility to finance the obligation effectively. Factor in interest rates, terms, monthly payments, and potential charges to make an wise choice that meets your financial goals. A comprehensive assessment will provide insight into the financial implications of your decision, empowering you to reach a sound outcome.

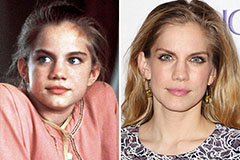

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Barbara Eden Then & Now!

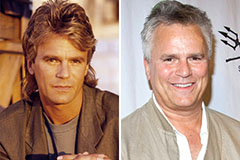

Barbara Eden Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!